Direct Write-off Methodology Definition And Meaning

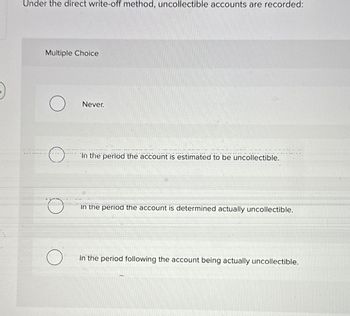

Under this technique, companies wait till a specific account is deemed uncollectible earlier than recording the unhealthy debt expense. When this occurs, the corporate immediately reduces the accounts receivable and recognizes the dangerous debt expense on the income statement. Quite, an account receivable is written-off on to expense solely after the account is determined to be uncollectible. The Direct Write-Off Method of Accounting for Uncollectible Accounts acknowledges uncollectible accounts as expenses solely when they’re deemed uncollectible. Not Like the Allowance Method, this technique doesn’t require the creation of an allowance account.

Regardless Of initial contact, the client stops responding after receiving the ultimate web site files. My Accounting Course is a world-class educational useful resource developed by experts to simplify accounting, finance, & investment evaluation matters, so college students and professionals can be taught and propel their careers. If you’re required to comply with GAAP—due to audits, external traders, or public reporting—you’ll want to make use of the allowance method as an alternative. Even though they’re each used to account for unrecovered money owed, there are variations of their fundamentals and implications. Let us understand the direct write-off technique journal entries with the help of a couple of examples.

- At the top of the fiscal 12 months, the retailer’s accounts receivable steadiness is $100,000.

- The direct write-off strategy may be easier if you run a small enterprise and do not frequently deal with dangerous debt.

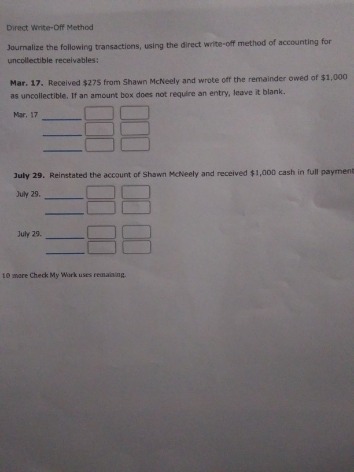

- To hold the business’s books accurate, the direct write-off technique debits a foul debt account for the uncollectible amount and credits that very same amount to accounts receivable.

- While the direct write-off method could provide simplicity, it compromises the integrity of financial reporting and evaluation.

- Companies that operate on a cash basis or don’t have important receivables usually use this methodology as a outcome of its simplicity.

- If the fee is still outstanding several months later and the corporate decides to write off the debt, the expense will be recognized in a unique fiscal year than the revenue from the sale.

Accounting Of The Direct Write Off Methodology

This estimation process can be complicated and may differ from one firm to another, doubtlessly leading to inconsistencies in financial reporting. The Allowance Methodology complies with Typically Accepted Accounting Principles (GAAP), which require that bills be matched with the revenues they assist generate. This technique ensures that financial statements are constant, comparable, and provide a fair illustration of the company’s financial position. Whereas the direct write-off method may offer simplicity, it compromises the integrity of monetary reporting and analysis. It Is essential for stakeholders to know the implications of this method and think about the advantages of more accurate alternate options like the allowance methodology for a clearer monetary image.

Customer Stories

Credit checks assist identify potential dangers and stop extending credit to high-risk prospects. This coverage outlines the phrases and conditions underneath https://www.simple-accounting.org/ which credit is prolonged to prospects and serves as a guide for all credit-related choices. A written rationalization outlining the rationale behind the decision to write off the debt further strengthens the legitimacy of the motion. In circumstances involving authorized proceedings, paperwork similar to bankruptcy filings should also be retained. Maintaining this thorough audit trail not only protects the business during external audits but also ensures compliance with accounting standards and enhances the effectiveness of inside critiques. The getting older technique is generally thought-about probably the most correct but additionally requires extra detailed record-keeping and evaluation.

Ultimately, businesses have to carefully think about their particular circumstances and necessities to decide on the most suitable method for accounting for bad money owed. The Allowance Method includes estimating bad money owed in advance and establishing an allowance for uncertain accounts. This technique adheres to the matching principle, because it matches unhealthy debt bills with the revenues they help generate. At the tip of each accounting period, the corporate estimates the quantity of uncollectible accounts based on historical knowledge, trade averages, or other relevant elements. This estimated quantity is recorded as a foul debt expense and a corresponding credit score to the allowance for doubtful accounts. When particular accounts are deemed uncollectible, they’re written off in opposition to the allowance.

So it’s often only used for inside books or by corporations not certain by Typically Accepted Accounting Ideas (GAAP). Let’s assume that a company begins operations on November 1 in an trade where it’s common to give credit score terms of web 30 days. The timing of dangerous debt recognition is a key differentiator between the Direct Write-Off Methodology and the Allowance Method. Credit managers, however, might view the direct write-off method as a needed evil. Regular evaluations of credit score insurance policies are important to ensure they proceed to be aligned with evolving market situations and customer needs. Additionally, credit methods ought to all the time replicate broader enterprise goals, fostering sustainable development while maintaining sound financial self-discipline.

For instance, the corporate ABC Ltd. had the credit score gross sales amount to USD 1,850,000 in the course of the yr. With the allowance methodology, companies anticipate the likelihood of some prospects defaulting on funds. Somewhat than ready for confirmation, they create an allowance or reserve primarily based on historical knowledge and expected trends. This is completed at the end of an accounting period to match anticipated unhealthy debts with the related revenues. With the direct write-off method, there is no contra asset account similar to Allowance for Uncertain Accounts.

This entry information the expense whereas maintaining the gross amount of accounts receivable on the stability sheet. According to IRS pointers, businesses can solely deduct unhealthy debts on their tax returns in the event that they use the direct write-off method. As a outcome, many small businesses persist with the direct write-off method to make sure their bad debt losses are acknowledged for tax purposes. The direct write off methodology violates GAAP, the commonly accepted accounting principles.

Offer An In Depth Instance Of How To Estimate And Regulate Allowances For Bad Debt

Bad debt is an inevitable risk in any enterprise that extends credit to its clients. In the direct write-off method, you only record an expense for uncollectible accounts when you’re absolutely sure a specific customer won’t pay. Under the direct write-off technique of accounting, the full amount of the sum owned by the customer is reported by the entity when the credit sale is made. Nonetheless, if the entity has a huge amount of accounts receivable which could not be collected, the amount in the accounts receivable account could be too excessive. As an alternative to the direct write-off technique, you may make a provision for dangerous debts based mostly on an estimation of future bad money owed in the identical period that you simply recognise revenue. This system aligns revenue and expenses, making it the extra palatable accounting technique.

This removes the receivable from your books and displays the loss as an expense—simple. Learn how small companies can deal with bookkeeping effectively and scale faster with clean books. Due to the drawbacks of the direct write-off method, the allowance methodology is more regularly used.